Schroders Plc is pruning the size of its executive committee to nine members from 22, marking new Chief Executive Officer Richard Oldfield’s push to revive the fortunes of the UK’s largest standalone asset manager.

Article content

(Bloomberg) — Schroders Plc is pruning the size of its executive committee to nine members from 22, marking new Chief Executive Officer Richard Oldfield’s push to revive the fortunes of the UK’s largest standalone asset manager.

As part of the overhaul, Ed Houghton, who was most recently a director at Legal & General Group Plc, will join Schroders and its management committee as head of strategy and investor engagement, according to a statement seen by Bloomberg News. Mary-Anne Daly will continue on the panel, overseeing wealth management; private-assets head Georg Wunderlin will become head of Schroders Capital; and, Karine Szenberg will take over as the sole head of the Client Group.

Advertisement 2

Article content

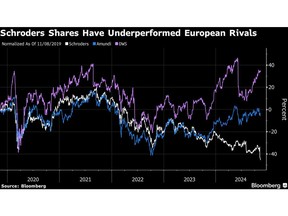

The sweeping action, Oldfield’s first as CEO, comes as he faces pressure to cut costs at the 220-year-old firm whose stock has slumped more than 50% in the past three years. Oldfield, who joined Schroders in 2023 as chief financial officer after more than two decades at PwC, didn’t rule out wider job cuts in an interview.

“We’re going through the process now of understanding what we want the shape of the business to look like,” the 53-year-old executive said, adding he will provide an update in March. “Our challenge is how we create simplicity” around the three main businesses “and then talk about what the gap between that is and what we have today and how we then manage that,” he said.

Oldfield is taking over the top job Monday from Peter Harrison, who had been at the helm since 2016. The leadership transition comes at a pivotal time for the money manager, which has faced criticism for its relatively high cost base and slower organic growth in its private markets business. Schroders manages £777 billion ($1 trillion) in assets.

In a sign of investors’ growing impatience, the company’s shares plunged almost 14% on Nov. 5, following a trading update that showed £2.3 billion of quarterly outflows and warned of £10 billion more in redemptions.

Article content

Advertisement 3

Article content

The move to downsize the executive committee brings Schroders more in line with its European rivals Amundi SA and DWS Group, which have an executive team count of 13 and 6 members, respectively. Members who are no longer part of the panel will still stay with the firm.

Oldfield said a review is underway of Schroders’ various businesses that encompass actively-managed public markets funds, a solutions unit that provides investment services to corporate pension plans, as well as wealth management and private markets divisions.

Schroders needs to position itself like some of the world’s upmarket grocers that have global presence and offer a wide range of high-quality produce, he said. The firm needs to have “high-end, streamlined operations” and “a really clear client proposition,” he said.

Private Markets

Under former CEO Harrison, the money manager expanded beyond its traditional mutual fund business, making a big push into the more lucrative area of private markets, including through the acquisition of renewable energy specialist Greencoat.

Fundraising, however, has been falling short of expectations as higher interest rates slowed sales of private assets globally and prevented large investors from redeploying gains into new funds.

Advertisement 4

Article content

Oldfield warned that the firm might not reach its goal of £92 billion in assets at its private markets division by 2025. “We have to come back to the market with targets that we are clear we can achieve in March,” he said.

The firm’s Cazenove unit, which caters to wealthy individuals, has seen consistent inflows over the past years. The business last month bought boutique firm Whitley Asset Management to further boost its access to the ultra-rich.

The slide in the share price and the appointment of the former accountant as boss have stirred some speculation in the City of London that Schroders could become a takeover target. The firm hasn’t been fielding any such approaches, Oldfield said.

The Schroder family holds about 44% of the firm. Leonie Schroder, a board member and the UK’s richest female financier, has been meeting clients in Australia and Japan over the last few weeks and will be opening the firm’s new Zurich office this month.

—With assistance from Ben Stupples.

Article content