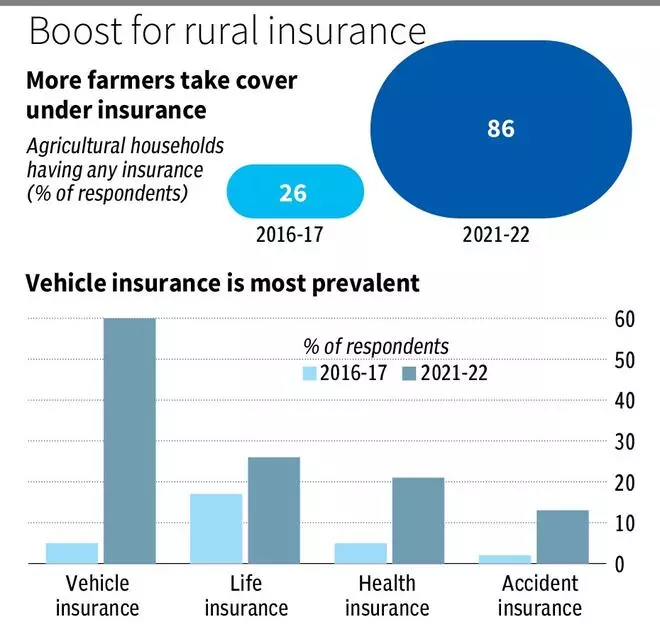

Awareness about the benefits of insurance cover appears to be growing in rural India. A recently released survey by the National Bank for Agriculture and Rural Development (Nabard) on financial inclusion shows that number of rural households taking insurance cover has improved sharply. While vehicle insurance is popular, crop insurance also finds many takers.

In 2021-22, 86 per cent of agricultural households reported having some form of insurance, a significant increase from 26 per cent in the 2016-17 Nabard survey. Among the types of insurance, vehicle insurance grew the most from 5 per cent in 2016-17 to 60 per cent in 2021-22. Health insurance rose from 5 per cent to 21 per cent, accident insurance from 2 per cent to 13 per cent, and life insurance from 17 per cent to 26 per cent in the same period.

Maya Kant Awasthi, who teaches Food and Agribusiness Management at IIM Lucknow, said the rise in various types of insurance such as vehicle, health and accident insurance in the rural area, can be attributed to the increased aspirations of rural people, market homogenisation, and the narrowing gap between urban and rural consumers due to greater interaction.

Fasal Bima cover increases

The PM Fasal Bima Yojana, which provides crop insurance across various stages of the crop cycle is the largest insurance scheme targeting farmers. This scheme has been expanding its footprint though the implementation is a little faulty.

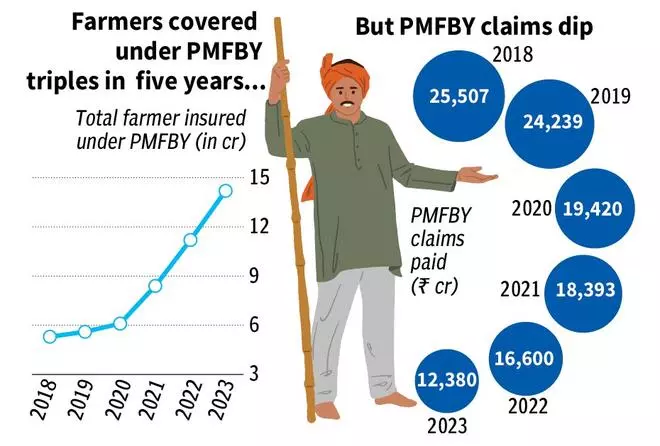

The number of farmers covered under the PMFBY has tripled in the past five years. In 2018, 5.3 crore farmer’s applications were insured under PMFBY, which grew to 8.4 crore in 2020 and increased further to 14.2 crore in 2023.

Data show that from 2016 to 2024, around 56.8 crore farmer applications were received under PMFBY. But only 41 per cent of farmer applicants received the amount claimed. The scheme covers 30 per cent of the gross cropped area across the country.

The overall claims made under PMFBY have also been decreasing. In 2018, claims totalled ₹25,507 crore, decreasing to ₹18,393 crore in 2021 and further declining to ₹12,380 crore in 2023.

Awasthi pointed out, “The promotion of groundwater expansion through tube wells, along with subsidies for tube wells and multiple irrigation sources, has reduced the impact of crop loss on the final tract of land. With these alternative sources, the chances of crop failure are lower, which in turn contributes to a decrease in insurance claims.”

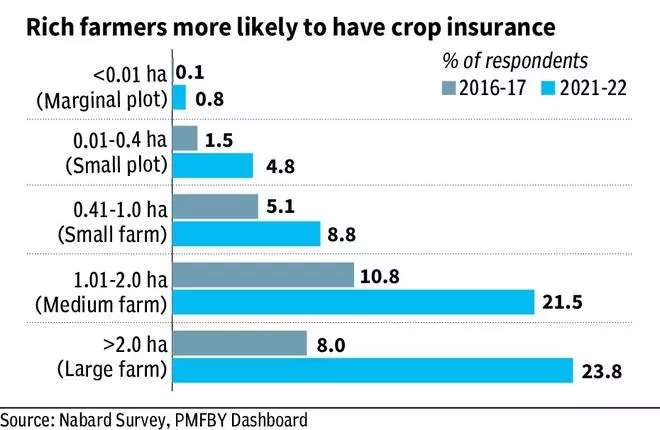

The Nabard data also indicatethat wealthier farmers are more likely to have crop insurance. Among farmers with more than 2.0 hectares of land (large farms), the proportion of respondents with crop insurance rose from 8 per cent in 2016-17 to 23.8 per cent in 2021-22. For farmers with 1.01-2.0 hectares (medium farms), the proportion increased from 10.8 per cent to 21.5 per cent, while for those with 0.41-1.0 hectares (small farms), it grew from 5.1 per cent to 8.8 per cent over the survey period.

Managing premiums

Elsevier’s Journal, Progress in Disaster Science, explains that wealthier farmers are more likely to adopt crop insurance due to greater liquidity and easier access to credit, which helps them manage insurance premiums. In contrast, less wealthy farmers often face limited cash flow, which can hinder insurance adoption unless they have access to formal credit options, such as bank loans.

The Standing Committee’s 2022-23 report highlighted issues with the PMFBY scheme, noting delays in claim settlements due to the late release of yield data and premium subsidies by States. Yield-related disputes between insurance companies and State governments remain a significant challenge.

The report suggests that insurance companies should establish offices in every tehsil, as farmers currently face difficulties with insurance-related issues due to the lack of local representatives to assist them.